Boston

-

Pharma, Artificial Intelligence, BioPharma

Novo Nordisk Turns to Flagship’s Valo Health for AI-Driven Cardio Drug R&D

Novo Nordisk is paying Valo Health $60 million up front to gain three preclinical cardiovascular disease programs. Milestone payments for those programs and others covered under the artificial intelligence drug discovery pact could reach up to $2.7 billion.

-

Startup Magnet Biomedicine Attracts $50M to Expand Scope of Molecular Glue Drugs

Magnet Biomedicine builds on decades of molecular glue research from its scientific co-founder, Harvard University Professor Stuart Schreiber. The startup is developing drugs that take these glues beyond the biotech industry’s current focus on targeted protein degradation.

-

Payer’s Place: Dawn Maroney

Dawn Maroney, President, Markets of Alignment Health and CEO of Alignment Health Plan, to discuss how they are using technology to provide better service and care to consumers.

-

Twice Rejected Diabetes Drug/Device Product Gets New Chance at Startup i2o

Intarcia Therapeutics’ GLP-1 agonist product candidate for type 2 diabetes now belongs to i2o Therapeutics, which will make the treatment’s case for approval at an upcoming FDA advisory committee meeting. The startup’s $46 million Series A financing is one of several recently announced funding rounds.

-

Devices & Diagnostics, BioPharma

Rigorous Data Are Key to Convince Payers, Investors in the World of Digital Therapeutics

Pear Therapeutics was once regarded as a digital therapeutics pioneer, but its spiral into bankruptcy has the industry searching for the best path forward. While some favor going direct to consumers, others say the solution is in generating more robust clinical trial data to persuade hesitant payers.

-

Eli Lilly Puts Up $60M for In Vivo Gene-Editing Med for Cardiovascular Disease

Eli Lilly’s partnership with Verve Therapeutics covers the development of a preclinical therapy addressing a protein associated with cardiovascular disease risk. The in vivo gene-editing therapy is a potential one-time treatment.

-

Ironwood Places $1B Bet on Biotech That Could Bring Its Next Blockbuster GI Drug

Ironwood Pharmaceuticals is paying $1 billion to acquire VectivBio, a biotech whose lead program could become a blockbuster treatment for a gastrointestinal disorder. Preliminary Phase 3 data are expected by the end of 2023.

-

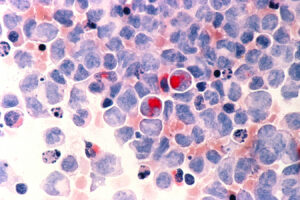

How Gamida Cell’s FDA Approval Could Reduce Racial Disparities in Stem Cell Transplants

The FDA approved Omisirge, an allogeneic cell therapy from Gamida Cell that could improve access to stem cell transplants as treatments for blood cancers. The biotech makes its therapy from umbilical cord blood.

-

Bio Startup Scorpion Partners With Pierre Fabre for Trials of Targeted Lung Cancer Drugs

Pierre Fabre is paying Scorpion Therapeutics $65 million to begin a partnership on clinical development and potential commercialization of two targeted therapies for non-small cell lung cancer. The Scorpion drugs could have safety advantages over approved Johnson & Johnson and Takeda therapies that address the same rare genetic signature.

-

Vertex Pays CRISPR Therapeutics $100M to Bring Gene-Editing to Type 1 Diabetes

Vertex Pharmaceuticals aims to use CRISPR Therapeutics’ gene-editing technology to develop type 1 diabetes cell therapies that don’t prompt the immune system to reject them. This approach could compete with a Sana Biotechnology program expected to reach its first test in humans this year.

-

Applying Remote Patient Monitoring to Surgery Prep and Recovery, Oncology and Women’s Health

Join us to learn about the latest trends in remote monitoring and how to extend its benefits beyond chronic conditions to more patients – all while using fewer staff resources.

-

Pear Therapeutics’ Cuts Are Not Enough; ‘Strategic Alternatives’ Among Next Steps

Pear Therapeutics isn’t meeting the commercialization goals for its prescription digital therapeutics, so it’s now seeking strategic alternatives for the business. Prospective buyers can pick up Pear’s FDA-cleared products for substance use disorder, opioid use disorder, and insomnia.

-

Aiming for an Epigenetics Edge, Chroma Raises $135M to Move Closer to the Clinic

GV led Chroma Medicine’s Series B financing round, which the biotech will apply toward epigenetic medicines that could offer advantages over other editing technologies. Other recent financings include rounds from Cargo Therapeutics and Transcend Therapeutics.

-

Blood Clotting Biotech Hemab Hauls In $135M to Drug Rare Bleeding Disorders

Hemab Therapeutics will apply its Series B financing toward clinical development of its lead drug candidate, a potential treatment for Glanzmann thrombasthenia. The capital will also support the rest its pipeline addressing rare bleeding and thrombotic diseases with no approved therapies.

-

Chiesi Wins FDA Approval for First Drug to Treat Ultra-Rare Enzyme Deficiency

Chiesi drug Lamzede is an engineered version of an enzyme that’s lacking in patients with the rare disease alpha-mannosidosis. FDA approval of the Chiesi drug comes about five years after European regulators authorized the product.

-

Karuna Picks Up Kidney Drugs for Chance to Challenge Boehringer Ingelheim in the Brain

Karuna Therapeutics has licensed two small molecules that shuttering Goldfinch Bio had developed for kidney disorders. These compounds target a pathway that could also treat neurological disorders, giving clinical-stage Karuna the opportunity to compete against a drug candidate from Boehringer Ingelheim.

-

Cancer Biotech Elicio Finds Path to Public Markets Via Angion Reverse Merger

Elicio Therapeutics dipped its toe in the IPO waters but decided to go public by merging with publicly traded Angion Biomedica. Clinical-stage Elicio is developing immunotherapies, including cancer vaccines, that work by targeting immune cells located in the lymph nodes.